grinvalds/iStock via Getty Images

grinvalds/iStock via Getty Images

The following segment was excerpted from this fund letter.

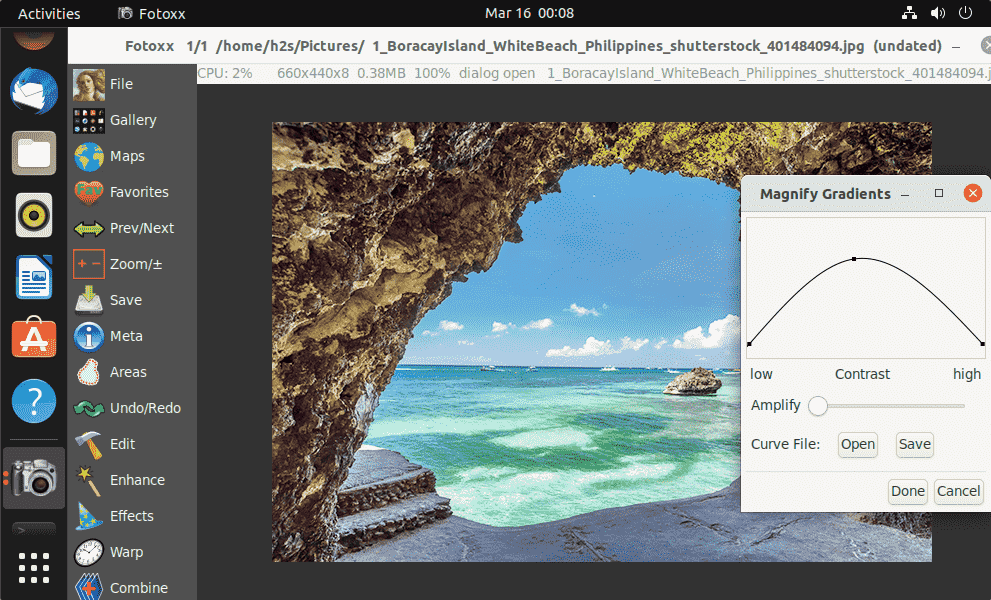

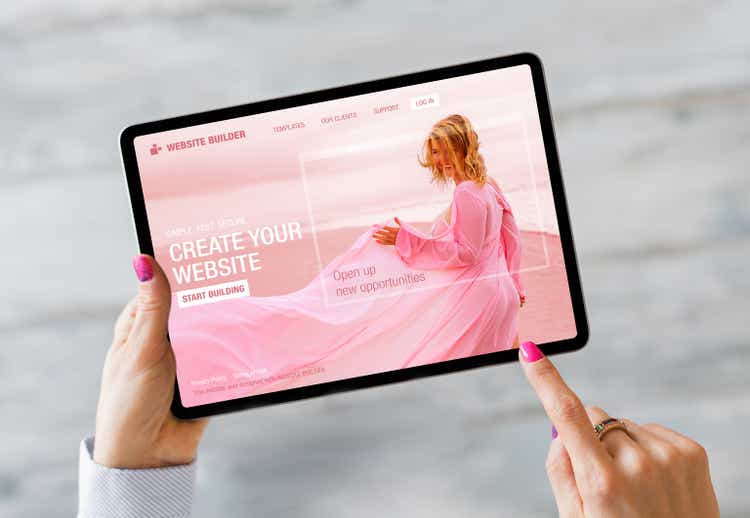

One recent investment we made is in Squarespace (NYSE:SQSP). Squarespace offers a do-it-yourself website product, as well as some ancillary products including marketing and analytics tools, and domain registrations. Instead of hiring a traditional website developer and paying thousands for a website, most people can use templates and drag and drop to create a professional looking website for just $12 per month. They offer websites for all types of businesses, including e- commerce, restaurant bookings, paid content section, appointments, etc.

Their closest peers are Wix (NASDAQ:WIX), GoDaddy (NYSE:GDDY), and Weebly. GoDaddy’s offering is far more basic and tailored to people who want a super simple website up and running very quickly. Wix is very similar but also offers slightly more advanced functionality, giving the user more flexibility in design. Weebly is very similar, but some users report slow down issues once a site reaches a certain size. Shopify (NYSE:SHOP) is also a competitor, but their website offering is very basic and they are solely focused on e-commerce. Squarespace also integrates with Shopify, so a user can create a more beautiful website using Squarespace then use Shopify for the e-commerce back end. Most agencies use WordPress which still accounts for a large percentage of websites; however, WordPress requires coding skills and is not even close to the product offering of companies like Squarespace. As for number of users, Wix has about 6 million premium subscribers, Squarespace about 4 million, and Weebly and GoDaddy have about 1 million each (estimates).

Wix and Squarespace are the industry leaders. Since they have 5x more subscribers than peers, they can spend way more on research and development in order to deliver a superior value proposition. Squarespace recently acquired a restaurant reservation platform, as well as some social media management tools to boost their value proposition. I don’t see a reason for a potential customer to choose the platform with an inferior product offering, especially when pricing is similar across the board. Also, once a user creates a website and is up and running, they are not very likely to switch and spend the time to re-create their website on a new platform. This creates customer captivity and long lifetime values. Both companies are also targeting third party developers to use their platforms in order to build websites for their clients. Squarespace even makes it possible to add custom code for more advanced users in order to gain additional functionality.

Anthony Casalena is the founder and CEO of Squarespace. He started Squarespace while in college and has been running it ever since. He owns about a third of the shares outstanding and seems very competent and passionate about his business. Looking at their Glassdoor, 88% of people approve of the CEO, and their overall ranking is 4.1 out of 5. They recently hired a chief product officer with 15 years’ experience at Adobe and a new CFO with experience at Booking Holdings (NASDAQ:BKNG).

As for valuation, the key drivers of revenue are number of subscribers and average revenue per subscriber. I am forecasting about 500k new subscribers per annum for the next five years, which will lead to about 6.5m subscribers by 2026. I think a lot of subscriber growth is tied to new business formations, which has only been growing in recent years in the U.S. I’m also forecasting ARPU will grow low single digits. Summing these up gives me a growth rate of about 13% for the next five years for revenues. I am also assuming steady state operating margins will be about 30% once growth sales and marketing expense slows down. This gives me an intrinsic value of about $50 per share, compared to the current market price of about $30 per share, a healthy discount and satisfactory forward internal rate of return.

Some risks to consider to the thesis are excessive competitive pressures from Wix, resulting in ARPU pressures. Also, they are heavily reliant on S&M to grow, and these new Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOG) changes could hurt ad spending ROI and drive up customer acquisition costs. However, Wix has said that 50% of their traffic is organic, I’m not sure on the number for Squarespace but if its similar that would mean they have created strong brand recognition. Another risk is companies like Google and Meta Platforms / Facebook (NASDAQ:FB) make websites less important. Google provides basic business information, allows users to book reservations, and even includes reviews. However, I still think a website is important for almost all businesses, and considering the low cost, it’s still a terrific investment.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Additional disclosure: This letter is for informational purposes only and does not reflect all of the positions bought, sold, or held by MPE Capital. Any performance data is historical in nature and is not an indication of future results. All investments involve risk, including the loss of principal. MPE Capital disclaims any duty to provide updates or changes to the information contained in this letter. For more detailed information of MPE Capital’s fee structures and/or general information please refer to our form ADV Part 2 brochure.

Performance information for a model account is shown. Individual client net returns may vary based on timing of account opening, timing of account closing, fee structure, and other factors not implicitly stated.

Fee assessment began July 25, 2017 due to state registration approval. Client results will vary slightly due to separately managed account structure. Performance numbers assume you were a client since the inception date

As of March 2021, qualified client fees are a 0.5% fixed management fee and a 15% performance fee in excess of a 6% hurdle rate and subject to a high watermark. Non-qualified client fees are solely a 1.5% fixed management fee.

Past performance is not indicative of future performance. Inherent in any investment is the possibility of loss.

Indices are provided as market indicators only. It should not be assumed that holdings, volatility or management style of any MPE Capital investment vehicle will, or is intended to, resemble that of the mentioned indices. The comparison of this performance data to a single market index or other index is imperfect because the former may contain options and other derivative securities, may include margin trading and other leverage, and may not be as diversified as the S&P 500 Index or other indices. Index returns supplied by various sources are believed to be accurate and reliable.