Verb Technology Co., Inc. is one of the sponsors for the upcoming Benzinga Global Small Cap Conference set to take place on December 8-9, 2020.

As a result of the pandemic, online shopping has taken over the retail market. Government-imposed safety measures have been a main driving force behind this massive shift, with many choosing to stay indoors. And as online shopping becomes the new norm among consumers, many companies have had to rethink their business models to account for this change.

According to a study conducted by DealAid, 90% of consumers have spent more time shopping online since the start of the health crisis. This year's Black Friday also saw a record-hitting increase in clicks with online shopping surging nearly 22%, according to Adobe Analytics.

And in observing these new spending behaviors, it's important for companies to create engagement that corresponds with this new landscape (which doesn't seem to be going away any time soon). A recent McKinsey report showed that more than 60% of consumers had changed their shopping habits, and shopping online is expected to grow 37% more next year.

One such company that is helping companies adapt to this online market is Verb Technology Co., Inc. (NASDAQ: VERB). Verb is a Software-as-a-Service (SaaS) company that is reshaping how businesses attract and engage with customers. The company's products are cloud-based, accessible on all mobile and desktop devices, tailored for individuals and enterprise users, and produce real-time measurable results.

How Does Verb Work?

Today people consume information rapidly, and companies need to find ways to communicate and create engagement. Verb offers video-based sales enablement applications, including interactive livestream e-commerce, webinar, CRM, and marketing applications for entrepreneurs and enterprises that use video as a way to interact and eliminate friction from the buying process.

Verb combines current trends that show that video is 80% more engaging than text/images, allowing customers to enhance their buying experience. In fact, the company is considered one of the most effective sales tools in the market today, and its technology is being integrated into popular ERP, CRM, and marketing platforms such as salesforce.com, inc. (NYSE: CRM), Adobe Inc (NASDAQ: ADBE) Marketo, Oracle Corporation (NYSE: ORCL) NetSuite, and in the future, Odoo, and Microsoft Corporation (NASDAQ: MSFT), among others.

By 2022, 82% of the world's internet traffic is expected to be through video. Verb offers software to large enterprises and small business sales teams that need affordable, easy-to-use, and quick-to-get-results sales tools. The company understands the importance of consumers' video interaction and incorporates into its software click-in-video capabilities that can help increase conversion rates and customer engagement.

Verb’s Product Portfolio

Verb is a sales enablement software company and these are its solutions:

verbCRM: Combines the capabilities of customer relationship management (CRM), lead generation, and content management, with clickable in-video, e-commerce capabilities in an intuitive, powerful tool for both inexperienced and highly-skilled sales professionals.

verbLIVE: is an interactive live stream e-commerce and video webinar application with clickable in-video shopping capability for consumers. It also provides real-time viewer engagement data and interaction analytics.

verbLIVE combines the best features of popular live streaming, like Instagram-live or a Zoom Video Communications Inc (NASDAQ: ZM) conference, with the capability for users to add what they want to a shopping cart and buy it on the spot.

verbLEARN: an interactive video-based learning management system (LMS) that incorporates all of the clickable in-video technology featured in the verbCRM application adapted for use by educators for video-based education.

verbTEAMS: a self-onboarding version of verbCRM with built-in verbLIVE and 1-click synchronization with Salesforce.

Corporate Developments

Verb is available in over 60 countries in mobile and desktop formats. It has grown its client base steadily, adding 16 new clients this quarter. Its recent additions include Market America | SHOP.com and Shaklee.

These significant results can be seen in the latest company’s report. Its third-quarter showed an almost 10% increase in Total Digital Revenue, a 16% increase in Total SaaS recurring revenue, and a 5% increase in Total Non-Digital revenue from the previous quarter.

In addition, the company recently launched verbTEAMS for solo entrepreneurs and small business CRM, and just completed the acquisition of SoloFire — a platform for health and life science sales enablement that offers immediate entry into the attractive medical sales market.

Another important development is the completed integration of the application verbLIVE, with the platform of enterprise CRM salesforce.com, inc. (NYSE: CRM).

“While our third-quarter results demonstrate the continued growth in adoption and deployment of our verbCRM application among large sales enterprises, verbLIVE — our interactive video-based livestream e-commerce and webinar product — continues to draw significant interest, setting the stage for what we expect will be explosive revenue growth throughout 2021,” said Rory J. Cutaia, CEO of Verb.

To learn more about Verb, click here.

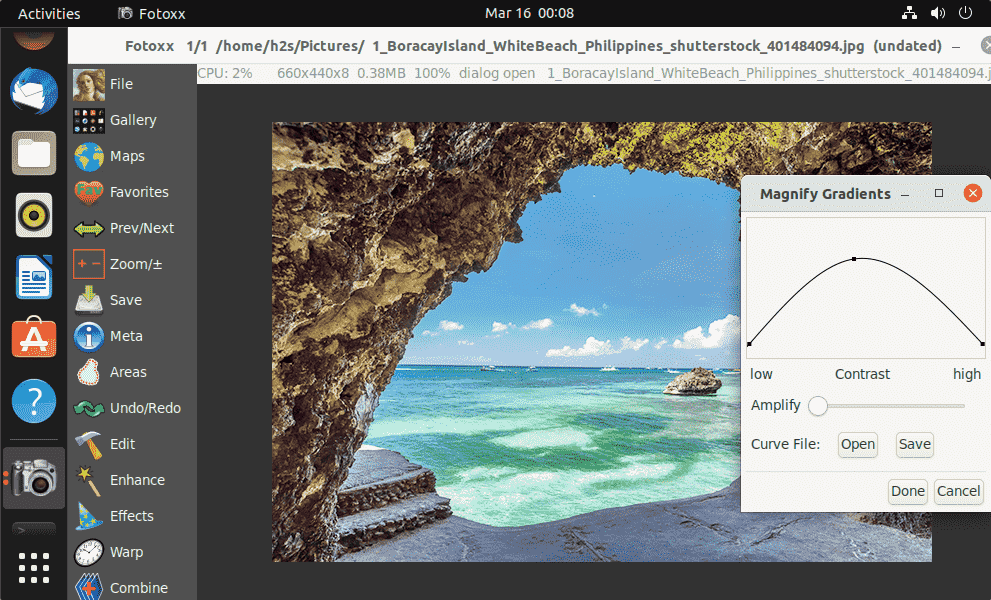

Image courtesy of Verb

See more from Benzinga

Click here for options trades from Benzinga

Cannabis Movers & Shakers: Pure Harvest, Allied, Bluma, Vitalis, Aurora, MedMen, Flora Growth

Will FuelCell Or Plug Power Stock Grow More By 2025?

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

As it turns out, during so-called Federal Reserve interest rate-hike cycles, which we seem set to enter as early as March, the U.S. stock market tends to perform strongly, not poorly.

As the threat of a Russian invasion of Ukraine remains on the radar, analysts and traders assess the ripples such an event would send through global financial markets.

Inflation is at 40-year highs. These stocks can help ease the pain.

The automotive sector is in the midst of an enormous change. A combination of social and political forces are pushing the industry more and more toward adoption of electric vehicles (EVs) as a new standard – although the internal combustion engine is not likely to be fully phased out, EVs are certain to find a large niche. ‘Last mile’ delivery, and various fleet businesses are already finding that EVs can meet their needs efficiently. But the electric car market isn’t just about cars. They may g

Low rates and high inflation make cash tough to hold. Look here instead.

Buy the dip, wrote J.P. Morgan’s strategists early this past week. Yes, the U.S. inflation rate just hit 7%, the highest since 1982, back when E.T. was phoning home and the rich kid on my street got a Commodore 64 computer—his old man worked for IBM. J.P. Morgan compares now with late 2018, when rate increases sparked a stock selloff, and the Fed later reversed course.

Last year, shares of fintech giant PayPal Holdings (NASDAQ: PYPL) fell as investors weren't pleased with the company's decelerating revenue growth. The market is accustomed to PayPal delivering higher growth rates than that, which explains why some investors aren't too optimistic about the company right now. In 2020, PayPal's business experienced abnormal growth as customers shifted their habits at the onset of the pandemic.

(Bloomberg) — The CES technology show in Las Vegas last week was an important milestone for Elon Musk’s Boring Co., which operates a network of underground tunnels to ferry passengers around the massive convention center in Tesla Inc. cars.Most Read from BloombergDirecTV to Drop One America News in Blow to Conservative ChannelShould I Be Wearing an N95 or KN95? Understanding the Evolving Advice on MasksCovid Pandemic May Shift to Endemic in 2022, Moderna Chair SaysCannabis Compounds Prevented C

Everyone loves fast-growing S&P 500 companies — they just don't want to pay up. Analysts are finding still-cheap growing companies.

You'll wait a few weeks or even months, but you get exactly what you want, and in this current market, you’re likely to save money, too.

The stock market rally is on the back foot, while the Nasdaq has lagged the S&P 500 for nearly a year. But Apple is holding up.

WASHINGTON (Reuters) -The largest satellite provider in the United States said late Friday it will drop One America News, a move that could financially cripple the rightwing TV network known for fueling conspiracy theories about the 2020 election. The announcement by DirecTV, which is 70% owned by AT&T, comes three months after a Reuters investigation revealed that OAN’s founder testified that AT&T inspired him to create the network. Court testimony also showed that OAN receives nearly all of its revenue from DirecTV.

Our call of the day from Michael Loukas, principal & CEO of TrueMark Investments, offers up 'category killers' in tech such as AI, cybersecurity and deep learning.

The company formally known as Square, is down about 31% since announcing its corporate entity name change to Block, on Dec. 1 of last year.

The electric vehicle company has a production plan that shows just how speculative its nearly $70 billion valuation is.

Find out which of Vanguard's value funds are the best for building a solid core-satellite value investing strategy for your portfolio.

Despite lagging the market in the past year, these two tech companies boast historical returns any company would be proud of.

(Bloomberg) — The tech stock-rout, as steep as it’s been, has still only pushed the Nasdaq Composite Index down about 8% from its November high, just shy of an official correction for a benchmark that’s more than doubled in less than two years.Most Read from BloombergCannabis Compounds Prevented Covid Infection in Laboratory StudyDirecTV to Drop One America News in Blow to Conservative ChannelCovid Pandemic May Shift to Endemic in 2022, Moderna Chair SaysFrequent Boosters Spur Warning on Immune

Investors are no longer patient with early-growth tech companies, especially in the electric vehicle sector.

If you're on the hunt for a few smart stocks that have the potential to maximize the earning potential of $200, then consider what Apple (NASDAQ: AAPL), Costco Wholesale (NASDAQ: COST), and Upstart Holdings (NASDAQ: UPST) have to offer. First, consider the company's fantastic growth from its services business. Apple's services include everything from sales in its App Store to its premium subscriptions (Apple One, Apple News+, AppleTV+ Apple Music, etc.), and business is booming right now.