Xero (OTCPK:XROLF) has experienced a deterioration in sales efficiency since the start of the pandemic. This highlights stronger competition particularly in international markets from peers who have strengthened their SaaS offerings in light of changes in customer working practices. We rate the shares as neutral.

In this piece we want to assess the following:

We will take each one in turn.

Bookkeeping and accountancy software for small business is traditionally a fragmented market dominated by local players. Add in digital transformation and cloud services, there is now a plethora of choice for business owners to contend with. Changing tax regulations and digitization has meant that even more players have been entering the market, some offering free and open source products such as Odoo and ZipBooks. Consequently, pricing plays a significant role but user familiarity is also a key reason for choosing a solution.

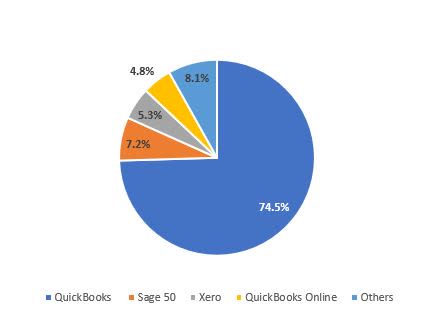

Despite the preference for some local flavor, global software giant Intuit (NASDAQ:INTU) is the undisputed market leader with its QuickBooks product which was launched back in 1983. Offering on-prem as well as SaaS, it is said that to have around 80% share of the global market as it arguably had first-mover advantage and has developed a large, loyal user base. However, we stress that this is primarily for the English-speaking world – there are strong local players in Asia such as Megi (unlisted) and Kingdee (OTCPK:KGDEY) in China and native SaaS player FREEE (OTCPK:FREKF), ORIX (IX) and Obic Business Consultants (4733) in Japan. Other strong local players include Sage (OTCPK:SGGEF) in the UK and Europe.

Accounting software market share

Source: Enlyft, created by author

Xero offers a cloud-native service that has an attractive entry-level pricing (although it has service limitations), and has made significant inroads in driving cloud accounting software penetration. In Xero’s core home markets of New Zealand and Australia, this penetration rate is at a high level demonstrating their strong progress. On the other hand, potential for future growth in those locations are now relatively limited, thereby placing the emphasis on growth overseas.

Cloud accounting market penetration rates by country – data from H2 CY2018

Source: FREEE, IDC, created by author

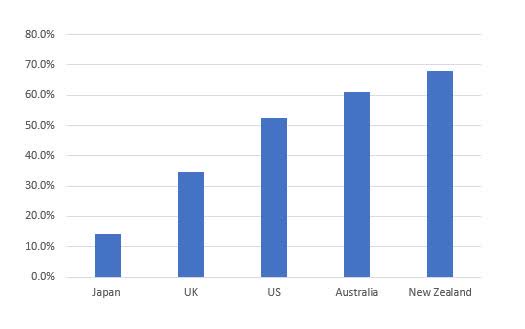

We can see the maturing profile of Xero’s core markets – Australia and New Zealand make up 77% of total H1 FY3/2021 sales. When looking at the annual recurring revenue (ARR) growth, we see the core market has seen consistent deterioration in growth. International ARR is said to have experienced high hurdles YoY as a result of deadlines over digitizing tax returns, making the slowdown more noticeable.

Xero ARR growth trend

Source: Company, created by author

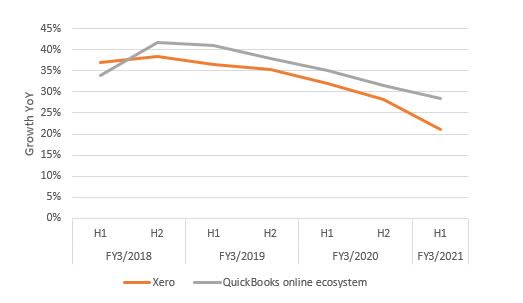

We wanted to compare Xero to Intuit’s small business QuickBooks online ecosystem performance. The only comparable disclosure available was quarterly sales, and we have matched Xero and Intuit’s numbers although Intuit’s quarter end is one month later. What is concerning is that compared to Intuit’s QuickBooks online ecosystem sales, the slowdown in sales at Xero is far more pronounced.

Quarterly sales growth trend – Xero versus QuickBooks online ecosystem

Source: Xero, Intuit, created by author

The trend in quarterly sales growth tell us that despite Xero’s profile as a challenger in the industry for accounting SaaS, in actual fact Intuit is growing faster and gaining market share as opposed to losing it. The growth gap between Xero and Intuit has widened in H1 FY3/2021.

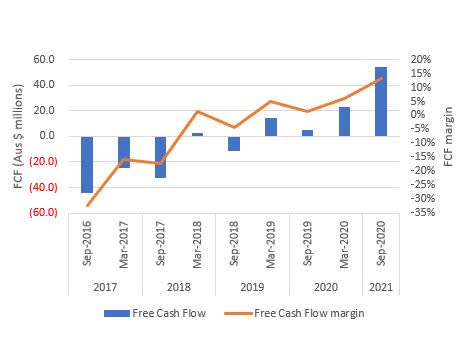

Next, we look at Xero’s outlook for free cash flow generation.

Xero has managed to generate free cash flow for the last four consecutive quarters, reaching a high free cash flow margin of 13.2% in H1 FY3/2021. The question is whether this level is sustainable for Xero, given its focus on growing its business overseas – a tougher proposition than in its core home market.

Free cash flow trend and margin

Source: Company, created by author

A major contributor to free cash flow margin improvement in H1 FY3/2021 was the reduction in selling and marketing expenses. The company puts this down to disciplined cost management in response to the pandemic. Disclosure also pointed to the average cost of acquiring a subscriber grew to $445 per gross subscriber compared to $382 in H1 FY3/2020, an increase of 16% YoY. We put this down as another sign of lower returns being made in a competitive overseas market.

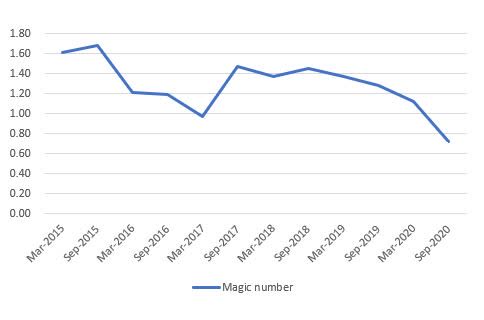

We like to assess sales efficiency of a SaaS business using the Magic Number. This measures the relationship between money spent on marketing, and money received as new revenue. Historically, Xero has registered in the top quartile of sales efficiency with a Magic Number around 1.3x. This metric dropped down to 0.7x in H1 FY3/2021.

Magic Number interim trend

Source: Company, created by author

This notable decline in sales efficiency has only been for one interim period, and arguably during very atypical business conditions. As the business scales, a number close to 1.0x is still of a fairly high standard. On the other hand, sales efficiency tends to be a fairly stable metric over time (as seen between September 2017 and September 2019), denoting a good go-to-market model that was repeatable and scalable. Despite the pandemic encouraging remote working and need for cloud access, it looks as if Xero’s model has become less effective since these work-from-home changes took place. It could also be possible that Xero’s peers really accelerated efforts for their cloud offerings and came to market in a major and unexpected manner as lockdowns were enforced.

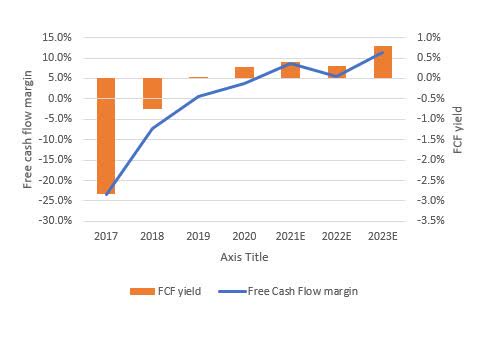

With this backdrop, we estimate sales and marketing costs will be increased, lowering free cash flow generation as Xero fights to regain sales momentum. Looking at consensus forecasts, we see that free cash flow margins are expected to dip YoY into FY3/2022, followed by a recovery into FY3/2023. Unless sales growth re-accelerates, we feel that free cash flow margins will not be reaching double-digits so soon in FY3/2023.

Consensus free cash flow forecasts and implied margin, and resultant free cash flow yield

Source: Company, created by author

From the above we surmise that Xero will not be able to generate double-digit free cash flow margins in the short to medium term, as it will re-focus on sales and marketing spend to generate more sales.

Xero’s sales growth rate continues to decelerate albeit with higher hurdles YoY, with consensus forecasting 22% YoY for FY3/2022 versus 30% in FY3/2020 and 36% YoY in FY3/2019. With deceleration we would prefer to see material free cash flow margin improvements which does not seem to be likely.

With the shares trading on FY3/2022 Price to sales 17x, PER 202x and a free cash flow yield of 0.3%, we see limited upside to the shares.

In the shorter term upside risk comes from sustained government support for small businesses to survive the pandemic – we believe the market has expectations of user churn to increase as fiscal stimulus ebbs away into H2 FY3/2022, particularly in geographies such as the UK. Renewed sales and marketing spend may also re-energize Xero’s outlook as sales efficiency recovers and the company can compete effectively with its peers such as Intuit and Sage.

Downside risk comes from continued decline in sales efficiency as the company finds it harder to make progress in international markets, whilst experiencing a maturing profile in its home markets. The company may overspend on sales and marketing with limited returns, and this trend may become more aggressive before sales trends recover.

Financing risk remains relatively high at Xero as the company continually issues new shares. The latest announcement on March 26, 2021, was a follow-on issuance of just over 1 million shares, raising $127 million Australian dollars. With plans to expand its platform via bolt-on M&A, financing may be seen as a positive event with limited dilution so far.

Xero has built a strong brand over the last decade and has become a serious player in cloud accounting. It does seem counter intuitive, but the pandemic seems to have made market conditions more competitive as opposed to acting as a tailwind for this cloud-native solution provider. Consequently, with the Magic Number metric pointing to falling sales efficiency, we believe the company will have to increase its sales and marketing costs which will hamper free cash flow generation in the short to medium term.

Whilst headline valuation multiples remain high, our focus is on free cash flow yield which on consensus forecasts for FY3/2022 stands at 0.3%. There is room for improvement in the longer term, and hence we rate the shares neutral. However, if evidence mounts that Xero is unable to make decent progress in international markets, we would revisit this recommendation.

This article was written by

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.